What Services Does Your Shop Offer? A Deeper Dive

What services does your shop offer?

Perhaps more interestingly, what services do shops that bring in a high amount of revenue offer?

We collected a lot of data for our recent State of Heavy-Duty Repair report. Like, a lot. So much that we didn’t include all of it in the report itself. But we aren’t just going to sit on it, either—this is the latest in a series of deeper dives into what we discovered. If you’re curious, you can read more about how shops handle inventory and what they charge for DOT and diagnostic inspections.

We hope this data and the analysis we provide will help you see what your competition is doing, whether you might benefit from offering more (or fewer!) services, and which services might prove most beneficial (read: KA-CHING!) for your shop.

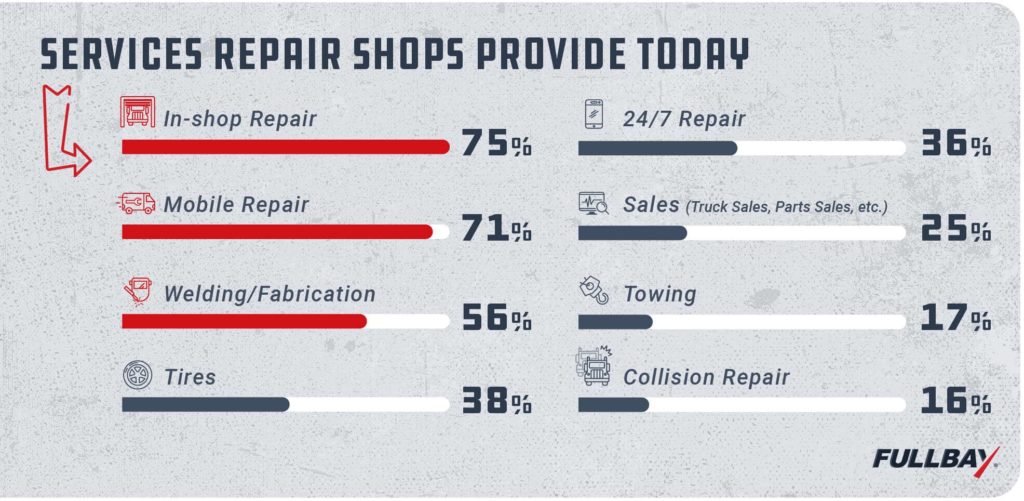

First, let’s quickly recap the services commercial repair shops are providing today, and what percentage of shops (per the report) provided each service. This data is from the State of Heavy-Duty Repair, and as a reminder, we obtained it through a “Select All That Apply” question.

THINGS TO CONSIDER BEFORE OFFERING A NEW SERVICE

Before we jump into the data, let’s get something out of the way. The data we’re digging through is U.S.-only (sorry, Canada! We’ll get you next time) and unless noted, it’s strictly drawn from independent repair shops.

Additionally, offering a new service at your shop is more than you snapping your fingers and going, “By Jove! I’d like to handle collision repair now.” You’ve got to consider your shop’s capabilities and your regional market. Data might indicate that collision repair is great for the money, but:

- You might not have any techs who handle collision work

- You’re surrounded by collision-only repair shops

- Your state doesn’t allow you to make collision repairs (we needed a third bullet)

Additionally, the revenue ranges shops see are influenced by more than just services offered. But we hope this data will be helpful to those of you thinking about expanding into a new service offering.

MONEY, MONEY, MONEY

Okay, Fullbay, you may be saying, let’s talk turkey! Do more services mean more $$$$$?!

Well…sometimes. But not always. Like many things, it depends.

To answer the money question, we looked at the shops that had made what we all consider to be a lot of money (to the tune of $1 to $2 million) per year. Twenty percent of the shops we interviewed fell into this range.

How many services do they offer? From that 20% chunk, we learned the following:

- 25% offer four services

- 17% offer five services

- 15% offer one service

- Shops offering two or three services both tied at 14%

- 10% offer six services

- 2% offer eight services

So, what does it all mean?

Well, by looking at the data we can see that there are a range of services that can signal when a shop will make above $1 million in revenue. Generally speaking, the “magic number” of services is four or five—if your shop is in that range, you stand a higher chance of making that higher income.

But wait, there’s more.

Two million dineros is nothing to sniff at. But there are shops out there reeling in between $4 and $6 million a year. What was their secret? How many services did they offer?

We took a look at their numbers.

- 4% of these high-earning shops only performed one service

- 27% of these money-making shops performed three services

- 23% of these high rollers performed four services

- 8% of these [insert witty money-making phrase] offered six or seven services

There are clearly a sizable number of shops making excellent money by offering three to four services. This could be because they have pinpointed the services their customers need the most; it could also be they did their market research and locked in the services their geographical area needs the most.

Honestly, we aren’t sure, but the data points to offering three and four services as a sweet spot for getting into that upper tier of revenue!

HOW CAN I GENERATE MORE REVENUE?

We know what you’re about to ask: What services coincide with the most revenue?

Unfortunately, we can’t exactly answer that question, because we are realizing we weren’t nosy enough in our survey. Next year…

We did, however, find out what services shops in certain income brackets offered:

- In-shop repair: 23% of shops offering this service reported $1 to $2 million in revenue

- Mobile repair: 41% of shops offering this service stated $500,000 to $2 million in revenue

- 24/7 repair: 23% of shops offering this service told us that this service pulled in $500,000 to $1 million

- Collision repair: 22% of shops offering this service brought in $1 to $2 million

- Tires: 23% of shops offering this service pulled in $1 to $2 million

- Towing: 36% of shops offering towing pulled in $500,000 to $2 million

- Welding: 24% of shops that offer welding hauled in $1 to $2 million

- Sales: 23% of shops offering sales cited earning between $250,000 and $500,000

If you’re considering branching out and adding new services to your shop, take a closer look at the three sections above. You can see a pattern—the shops that are making a lot of money tend to offer more services. You might want to look at tires, collision repair, and welding—shops offering these services on average seemed to have a higher percentage of shops that reported making up to $2 million per year.

DO WE SEE ANY DIFFERENCE IN REGIONS?

So, was there any kind of scenario where one region performed more of one service than another?

It’s a bit anticlimactic.

Spoiler alert: The Midwest leads in every single category.

Now, if you read the report, then you know the Midwest does account for 28% of all the repair shops in the country, so it’s not entirely surprising to see that the place with the most operations offers the most services.

We did see some variation in the second-place finishers; the West, for example, leads the rest of the pack in mobile repair while the Southeast was best of the rest among tires.

DOES AGE MATTER?

“Age matters not,” a famously misquoted muppet* once said. “Judge me by my age, do you?”

Alas, Yoda, age may influence a repair shop more than we initially thought.

We looked at the data another way, wondering if a shop’s time in business might lead to offering more or fewer services. Here’s what we discovered:

- 81% of the shops offering just one service were 12 years old or younger (and 43% of those shops were between six and 12 years of age)

- 43% of shops offering two services had been around for five years or less

- 39% of shops offering three services were fairly young (they’d been around five years or less), but 32% of shops that offered three services were 20 or more years old.

That last bullet is a particularly interesting split. Stay with us, though. We found that 36% of shops that provide five services were 20+ years old, while 40% of shops that offered 6 services were in the same age group.

The data seems to indicate that the older a shop is, the more services they offer (likely due to the size that comes with age). But the data still shows that many younger shops are interested in offering a lot of services.

INTERNAL VS. INDIE

So, we know internal fleet operations and independent repair shops both work on trucks—remember, this was a “select all that apply” question, so shops could choose multiple answers. But are there notable differences in what they do?

- 65% of independent shops offer mobile repair—as opposed to only 52% of internal fleets offering the same.

- 70% of independent shops offer in-shop repair; only 49% of internal fleets offer the same.

- 33% of independent and internal shops offer 24/7 repair services

- 36% of independent and internal shops offer tire service

- 24% of Internal repair shops handle collision repair; while only 21% of independent shops do

- 55% of independent shops offered welding; 40% of internal fleets did not

So, what don’t shops want to do? We saw our third tie for this section, as only 19% of indies and internal fleets offered towing as an option. This could be a question of expense, space, and additional training and licensing, as towing a semi is…well, you know.

We also took a look at how many shops offered sales to customers. Independents won here, with 26% of them offering direct sales. Internal fleets, being private, came in at 13%.

WHAT DOES IT ALL MEAN?

If all that information made your head spin, don’t worry! Put it down, grab a cup of coffee, and let it all just absorb for a while. And if you do decide you want to up your shop’s revenue by offering additional services, then make sure you look into the other factors that can impact your earnings. You know, stuff like your surrounding market, your competition, and your existing operation.

Lastly, if you haven’t checked out the 2022 edition of the State of Heavy-Duty Repair, then click here to download your free copy! It’s stuffed to the gills with diesel data, and it touches on topics like technician pay, operational challenges, and shop demographics. It’s great material for anyone interested in the industry or how their shop may stack up to their peers. Happy reading!

*It has come to my attention that Yoda is not, in fact, a muppet, but rather a puppet. I apologize to the great Jedi Master for this error.