Products

Solutions

About Us

Resources

Refer a Shop

Features

Estimates & Invoices

Easily send estimates to customers and receive electronic approvals before starting work.

Service Order Workflow

Receive repair requests and generate service orders quickly and efficiently.

Inventory Management

Manage parts across multiple locations and easily order from vendors.

Reporting

Get complete visibility on all aspects of your shop.

Customer Communication

Keep customers in the loop on repair progress with simple two-way communication.

Text Alerts

Fullbay’s Text Alerts allow you to reach customers and employees.

2-Way Texting

Turbocharge your communication by sending, receiving and managing customer text messages in Fullbay.

Integrated Accounting

Reduce administrative overhead with automated bookkeeping that syncs with accounting programs.

Integrations & Services

Fullbay’s leading technology integrates seamlessly with other industry tools.

Onboarding, Support, and Training

There’s all kinds of ways to learn how to use Fullbay! Our support services are completely free.

View All Products

Shop Essentials

Dieselmatic

Digital marketing solutions built for heavy-duty truck repair shops. Grow your business with a premium website, pay-per-click management, and more.

Learn More

Fullbay Payments

Accept and process credit cards, fleet checks/cards and ACH payments with next-day funding, all without leaving Fullbay.

LEARN MORE

Fullbay Connect

Fullbay Connect is the ultimate solution to access premium integrations and features, making life easier for everyone in the shop.

Learn More

Who We Can Help

Fleet Maintenance Management Software

Helps fleet managers maximize efficiency and extend asset lifespan.

Diesel Truck Repair Shop Software

Provide the fast, reliable service that customers want—with more profit and less headache.

Heavy Equipment Repair Software

Boost efficiency in your heavy equipment repair shop with fast, flexible software.

Mobile Truck Repair Software

Streamline your heavy-duty mobile operation—even when the team is miles apart.

Tow Truck Repair Software

Help your shop efficiently dispatch tow trucks, track repairs, and more.

Agriculture and Farming Equipment Repair Software

Provide the fast, reliable service that farmers need to keep their equipment working.

Fire Truck and Ambulance Repair Shop Software

Provide consistent, dependable repairs and maintenance that emergency vehicles can rely on.

Construction Fleet Maintenance Software

Keep the worksite safe and efficient with maintenance software built for construction equipment.

RV Repair Shop Software

Make sure every RV can explore the road with a safe, reliable vehicle

Read case studies from our customers

What Our Customers Say About Us

Shop Stories

See the improvements real shops experienced when they switched to Fullbay.

Learn More

Testimonials

Our customers take to video to share their stories about life with Fullbay.

Learn More

Reviews

What else are customers saying about us? Click here to read the raves.

Read Now

Who We Are

Our Story

A better life for shops leads to safer roads for us all.

Fullbay Cares

See how we give back to the essential workers of heavy-duty repair.

Our Company Values

We're all about creating a rewarding environment for our employees and customers.

Our Leadership Team

Fullbay is made possible by an incredible group of people, staring with our leaders.

Learn More About Fullbay

Building the Diesel Repair Community

Join the Fullbay Team

Looking for the next step in your career? Join the team and help us continue our mission to better life for shops and contribute to safer roads for us all.

Learn More

ALL ABOUT THE GRILLES STORE

Shop our 80+ diesel-themed products and contribute to a great cause! Check back frequently because we’re always adding more.

Learn More

Shop Owner Roundtable

Catch up on season 1 or watch the newest episodes of our hit series Shop Owner Roundtable!

Watch Now

Industry Resources & Best Practices

Blog

Get the latest trends and best practices in heavy-duty repair.

ROI Calculator

Free tool: How profitable is YOUR shop?

Webinars

Learn from the top industry minds

VIN Decoder

Check out the background of any truck.

Downloads

Download free educational guides and resources.

Parts Markup Tool

Determine your ideal gross profit and markup percentage,.

Podcast

Diesel Stories: A heavy-duty podcast for the heavy-duty industry.

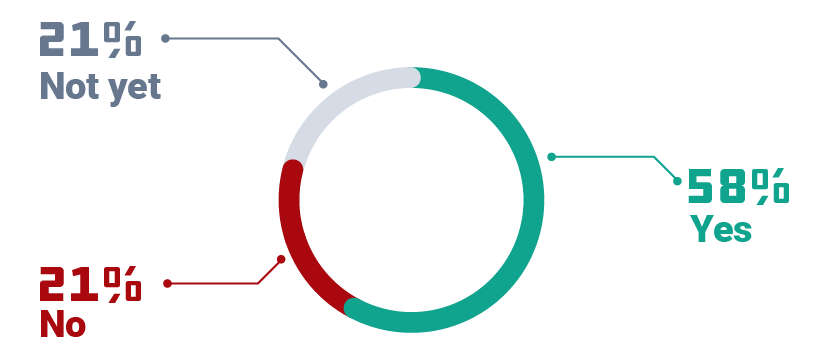

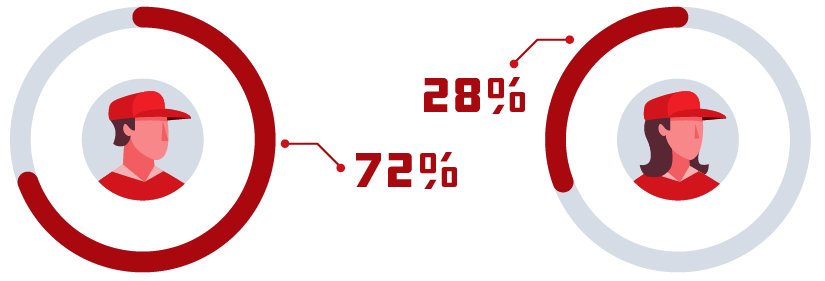

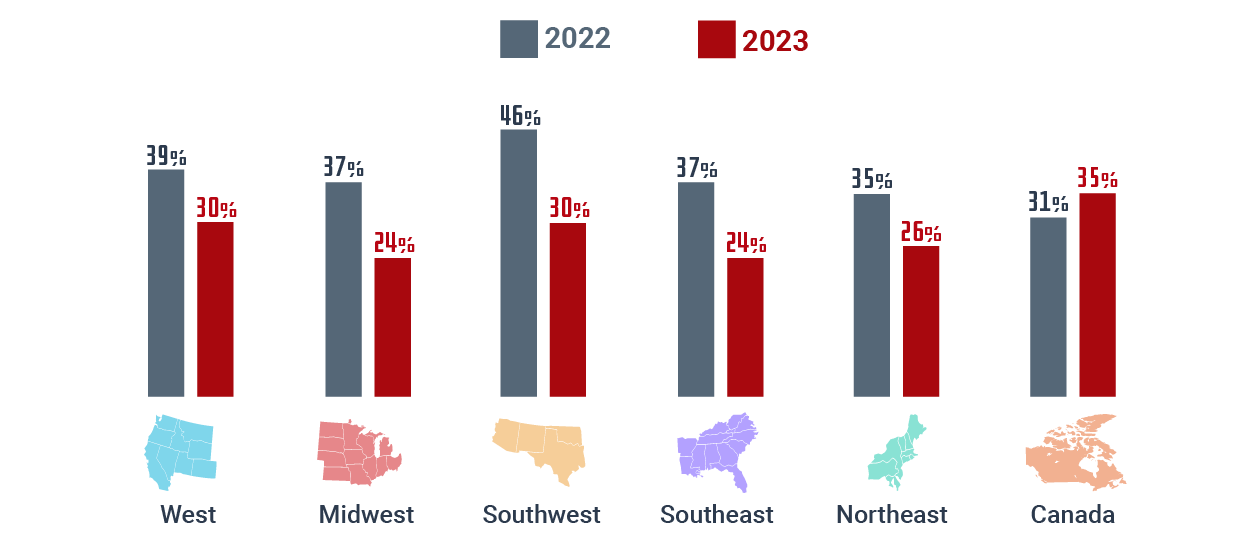

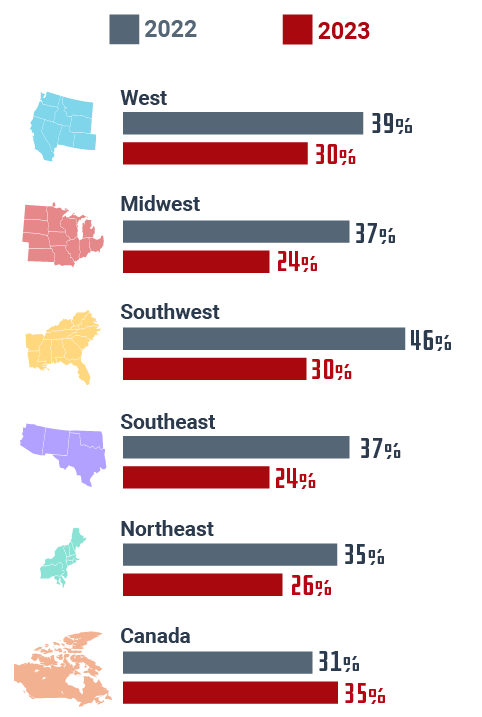

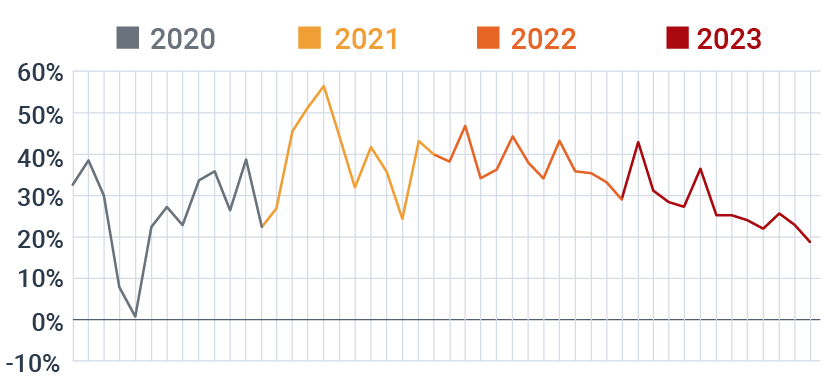

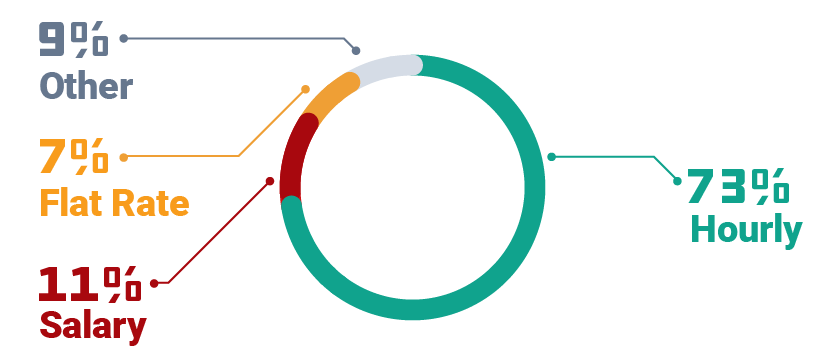

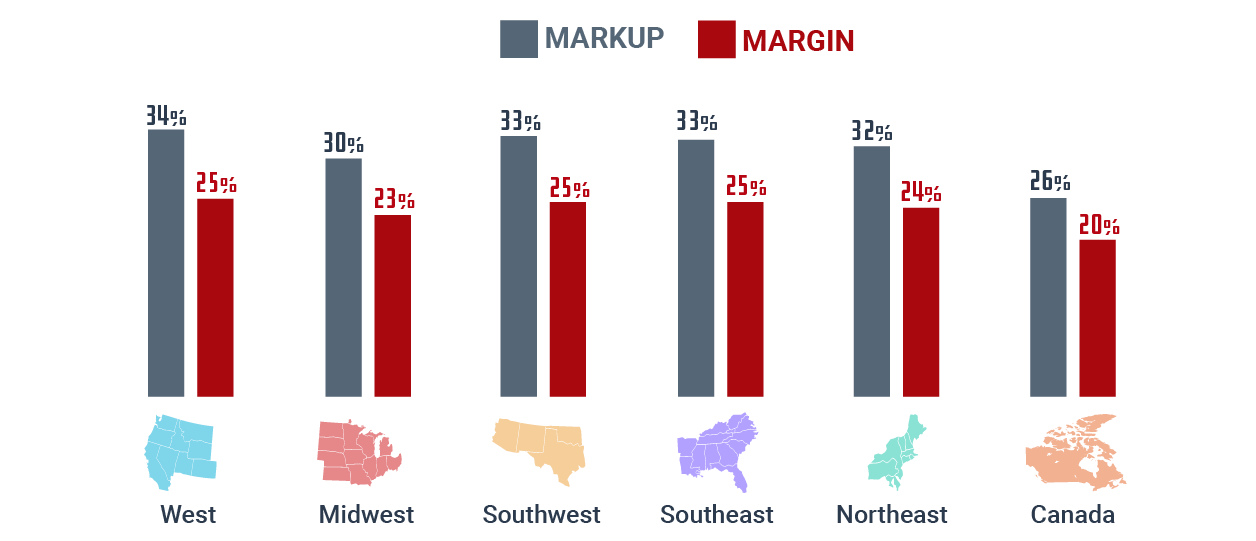

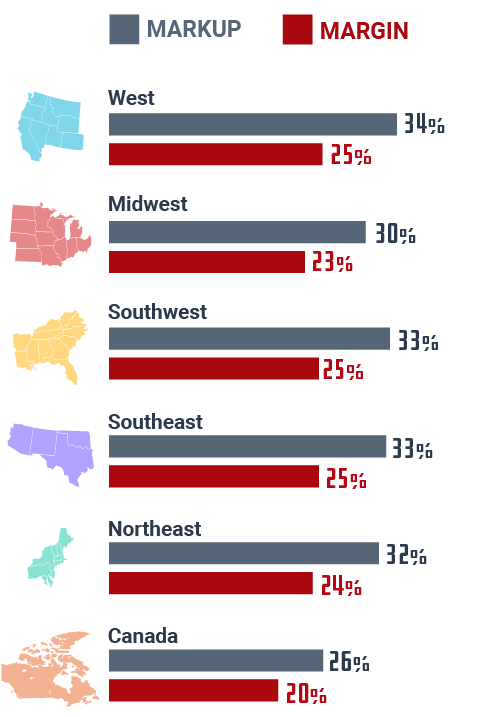

The State of Heavy-Duty Repair

The definitive report on the commercial vehicle repair industry.

View All Resources

)