A Diesel Shop’s Guide to Chargebacks

What is a chargeback?

(I know, I know. Silly question. Bear with us—it’s our obligatory way to score some SEO points.)

It is not, unfortunately, a battlecry or a funny catchphrase (“Brothers! With me! CHARGEBACK!”).

This is not what an actual chargeback looks like.

A chargeback is when a credit card company (or some other financial issuer) returns funds to a customer…by taking them away from you. It’s basically a refund, but it can have lasting repercussions—often because in the commercial repair industry, a chargeback is often initiated because the customer will claim that work was not completed correctly.

Notice we said claimed.

It turns out there are several reasons why a chargeback may occur. Some are pretty shady; others are honest mistakes. In the following article, we’ll go into more detail about why chargebacks happen, what you can do about them, and (of course) how Fullbay can help.

CHARGEBACKS & YOUR SHOP

Chargebacks can be particularly brutal for commercial repair shops. You aren’t just losing the money a customer paid; you’re also losing the time your tech(s) spent on it and any parts you procured for it. This isn’t a situation where a customer will return a product they don’t like. This is a 100% loss for your shop.

And it sucks.

“Like most painful things in life,” says Peter Cooper, Director of Operations at Absolute Repair, LLC. “[A chargeback] tends to leave a lasting impression.”

“Fighting these chargebacks is time-consuming and upsetting,” Matt Bean of HeavyTechs agrees, “because we are being accused of not performing the work.”

Obviously, the financial hit is a big one—Peter recollected getting stiffed on a $6,000 bill! But It’s also a strike against a shop’s hard-earned reputation. And as the Viking-era poem Havamal tells us, our reputation—good or bad—is eternal.

WHY DO CHARGEBACKS HAPPEN?

There’s a lot of reasons why a repair shop might face a chargeback. After polling some of our experts, we highlighted four primary causes:

- A repair failure. Here’s a simple example, courtesy of Luke Todd of The Service Company: Your shop repaired a check engine light, but the light came back on a few days later. “Rather than calling the shop,” he says, “the customer disputes the charge with their credit card company.”

- Poor bookkeeping. If a customer is haphazard with their records—or multiple people from a company or fleet are handling an account—something may be forgotten or lost in communication, and a chargeback occurs.

- Shady customers. While these are thankfully rare, they do occur often enough for our experts to mention them. Sometimes a customer just doesn’t want to pay a bill…and…well…chargeback.

- Typos. Yes, the dreaded typo continues to be an issue even in the twenty-first century. Someone is jabbing in letters and numbers that another person is reciting to them over the phone. Mistakes happen, and BAM! Chargeback.

Typos and poor bookkeeping can be corrected, but let’s expand on the unscrupulous customers or companies that many shops have experienced at least once. You’ve probably heard stories about, say, insurance companies that dispute any claim that comes through. Those who haven’t experienced it often dismiss it as semi-mythological.

Sadly, like most urban legends, this tale has an unfortunate grain of truth. One commentator spoke of two recent chargebacks his shop had received from the same company. He followed the digital trail of said company and discovered that disputing charges with their service providers is just their MO.

In addition, there are some truly wicked types out there who seem to target smaller shops, perhaps thinking they won’t fight back. Often, these smaller shop owners aren’t sure what to do, or just don’t have the resources or documentation (more on that later) to put up a fight. They’re often struggling, and feel they need to take on the work to keep the lights on…and so this trouble keeps happening.

“There are some that have it happen so often, their credit card processor stops letting them take cards,” Peter reports.

So yes, friends, there are some genuine jerks out there.

Here’s how to protect yourself.

STOPPING CHARGEBACKS BEFORE THEY HAPPEN

Like many things in life, prevention tends to be the best medicine. For a shop, that means implementing policies (and correct training) that will help avoid chargebacks.

The absolute best way to prevent chargebacks, according to all our interviewees, is to be extremely straightforward with your customers. That means making absolutely sure that everyone is on the same page when it comes to repairs.

“Everyone needs to know what we are fixing, what we are NOT fixing, and how much it is going to cost,” Luke says. “It is SO much better to have these discussions prior to the repair!”

It isn’t enough just to talk about repairs, though. You absolutely need a paper trail.

DOCUMENT, DOCUMENT, DOCUMENT.

Present all customers with detailed estimates. Make sure they sign off on those estimates.

This documented communication doesn’t just stop chargebacks in their tracks—it’s also your best defense against the odd chargeback that does occur. If you can provide written evidence that you took all the necessary steps and the customer agreed to proceed, an attempted chargeback likely won’t stick.

PREVENTING CHARGEBACKS WITH FULLBAY

We feel a little weird turning this into an ad for Fullbay, but honestly, this is where our friendly little app shines. Fullbay makes building out estimates and getting authorization easy—and it holds on to that documentation should you ever need to dispute a chargeback. Fullbay can also help out with the typo problem. “If a customer is paying us over the phone,” Luke says, “we always direct them to the portal,” thus reducing the threat of someone muddling an entry. The portal also requires a signature, so you’ll have that set, too.

Heck, Fullbay can combat a customer’s poor bookkeeping, too; because everything is kept in the cloud, it doesn’t matter who on the customer side is looking at records or authorizing repairs. Because all prior communication is stored, they can see everything that’s gone on so far and have all the data they need to make decisions.

Last but not least, Fullbay Payments enables you to receive ACH payments and fleet payments, which are bank-to-bank and verified funds released directly to you. No credit card company is involved.

OTHER WAYS TO PREVENT CHARGEBACKS

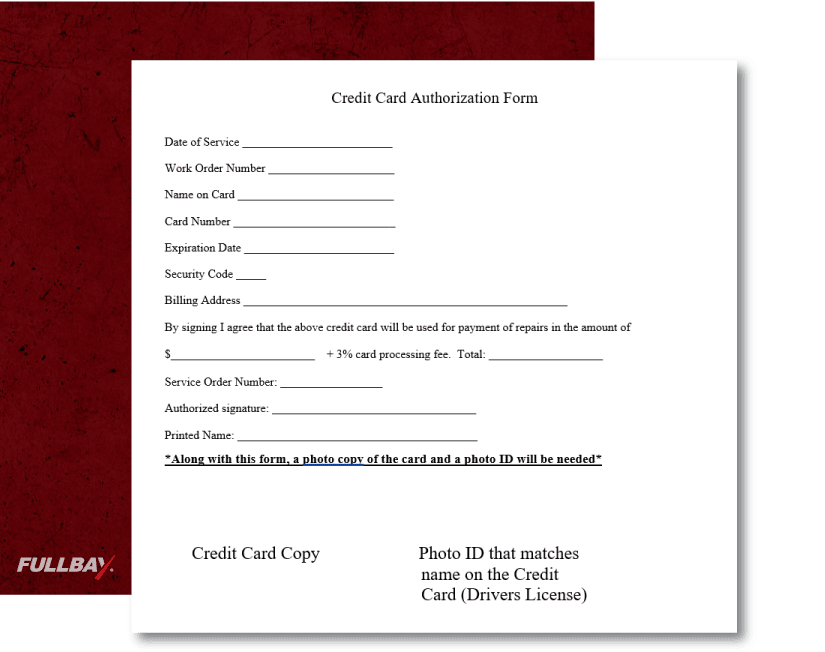

If Fullbay isn’t an option for you, or you want to amass yet more tools to combat chargebacks, Peter has some advice: “All transactions over $1,500 where the card is not present at the time of payment will require a card authorization form to be filled out,” he says. (Psst—you can get a look at that form here!*)

In addition, he trains his staff to size up argumentative customers. If, for example, a customer wants a break on costs and is being difficult, they might be the type of person who would dispute a charge, triggering a chargeback. If his team identifies a customer as a potential chargebacker, they won’t be able to pay with a card.

Chargebacks are at best unpleasant and at worst a real drain on your business, but you can get ahead of them by doing quality work and providing clear communication and documentation. Actually, let’s say it again: You need clear communication and documentation. More than anything else, these steps may save you from a lot of exasperation and heartache.

*Please note that this form is from Peter for review and use by other shop owners. Fullbay did not build this form, nor do we have legal authority to create forms like this. Basically, if you have any doubts before using something like this yourself, please contact a legal professional for help!